Bank of Canada raises interest rate 0.75%, indicates a further rise likely

https://www.bankofcanada.ca/2022/09/fad-press-release-2022-09-07/

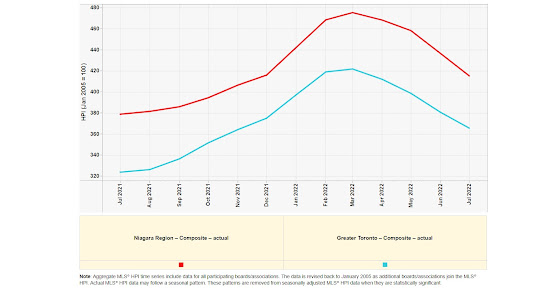

Yesterday the Bank of Canada raised the key interest rate by 0.75% to 3.25%, and has indicated that the rate will likely need to rise further (the next rate decision is October 26). For perspective, the Bank of Canada had slashed the key interest rate down to 0.25% during the "Covid years", which had a perhaps-unintended outcome of causing real estate prices in Southern Ontario (and many other areas of Canada) to skyrocket from June 2020 to March 2022.

Rising interest rates makes mortgages harder for Buyers to qualify for, and mortgage payments higher. During the past 5 months - as interest rates have been rising - we've seen a direct correlation with a steady, significant decline in real estate prices throughout Southern Ontario off of the February/March 2022 high. Yesterday's 0.75% hike indicates that, most likely, real estate activity will continue to be slow into the Fall, and house prices will continue to drop. This kind of news - a rising interest rate, and a likely further rise on Oct 26 - also gives some Buyers pause in that they perceive that real estate prices will fall further, so "why buy now, better to wait for the bottom of the dip".

Bear in mind that real estate prices are still higher than they were 2 years ago - before Covid - but the skyhigh pricing days (bidding wars, etc) are long gone.

Comments

Post a Comment