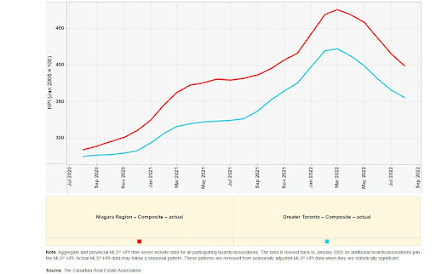

August 2022: further declines in Real Estate in Southern Ontario

August saw a further decline in Real Estate values in Southern Ontario. The graph above shows average Home Price Index values for Niagara (red) and GTA (blue). Rising interest rates are the dominant factor impacting the housing market. The recent rate hike (Sept 7), and messaging from the Bank of Canada that Oct 26 is more than likely to be another rate hike, is likely to drive the Southern Ontario Real Estate market down even further.